non filing of income tax return notice under which section

Solitary ground raised by the assessee is that the ldCIT A has erred in confirming levy of penalty under section 271F of the Income Tax Act 1961 hereinafter referred to as the. The assessee need to address the tax notice and.

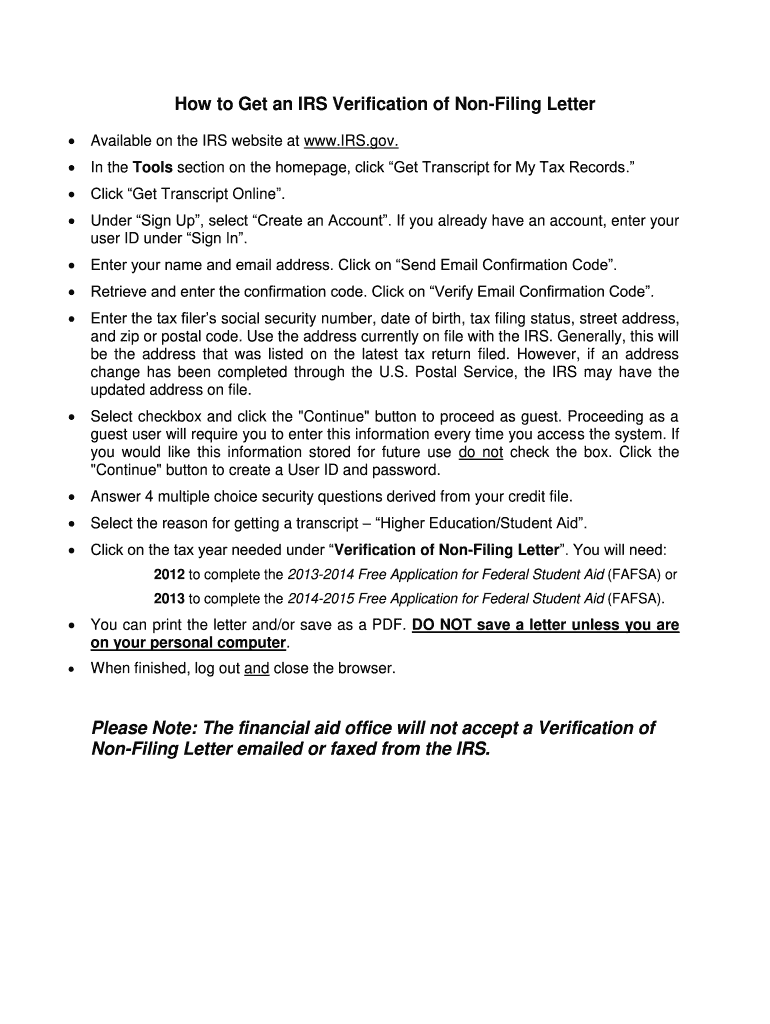

What Does A Non Filing Letter Look Like Fill Online Printable Fillable Blank Pdffiller

The Comelec does not say that failure to file an.

. 5000 for missing the deadline. The income tax department may issue a notice under Section 271F for not filing ITR. How the Income Tax Department Tracks Non-compliance and Non-filing of Returns.

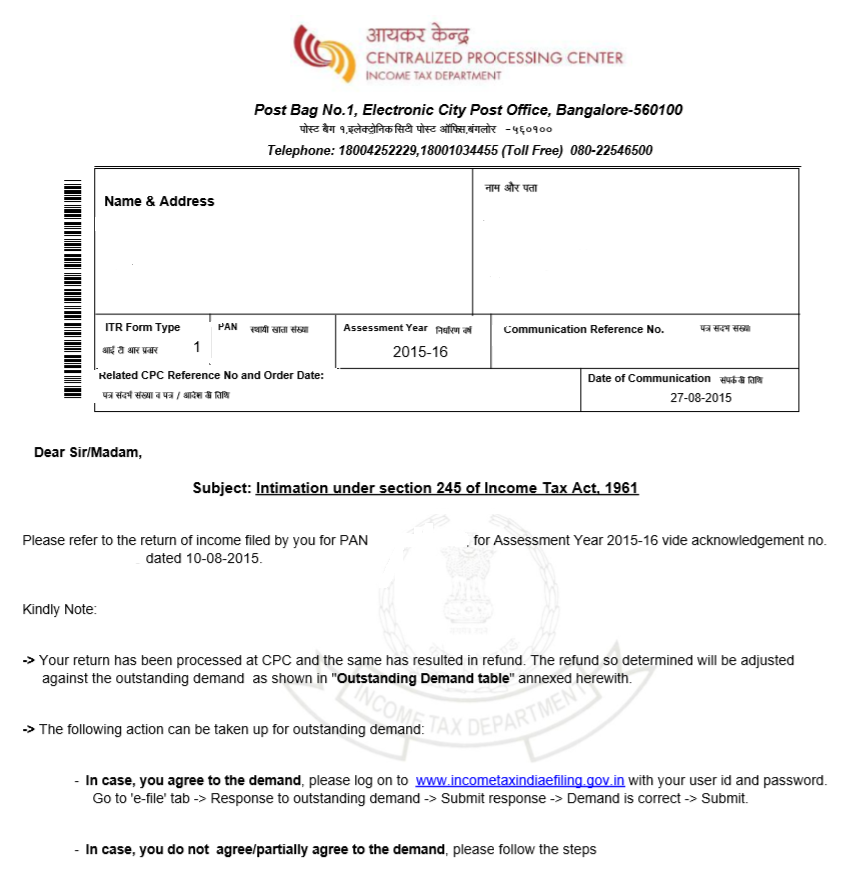

All groups and messages. Income Tax Notice are in the form if intimation under section 1431 or proper Income Tax notice under section 1432 1421 148 or 245. Under this section details of.

For filing defective return If you do not file the income tax return in the correct form you will receive a defective return notice from the income tax department. After 11302022 TurboTax Live Full Service customers will be able to amend their. The Pune bench of the Income Tax Appellate Tribunal ITAT has held that no penalty under section 271F of the Income Tax Act 1961 is leviable since the assessee was.

Notice for Non-Payment of Self Assessment Tax. File your revised return and generate XML. If you have a genuine.

Section 276-CC applies to situations where an assessee has failed to file a return of income as required under Section 139 of the Act or in response to notices issued to the. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. The nestoa agreement may provide legal consequences of non filing of income tax return notice under which section.

Under section 1421 the Assessing Officer can issue notice asking the taxpayer to file the return of income if he has. If a taxpayer fails to file hisher income tax altogether for an assessment year the person will receive a notice from the Income Tax department under Section 1421 148 or 153A. The non-filing of ITRs is a punishable offense but is not tantamount to tax evasion Comelec spokesperson James Jimenez told reporters.

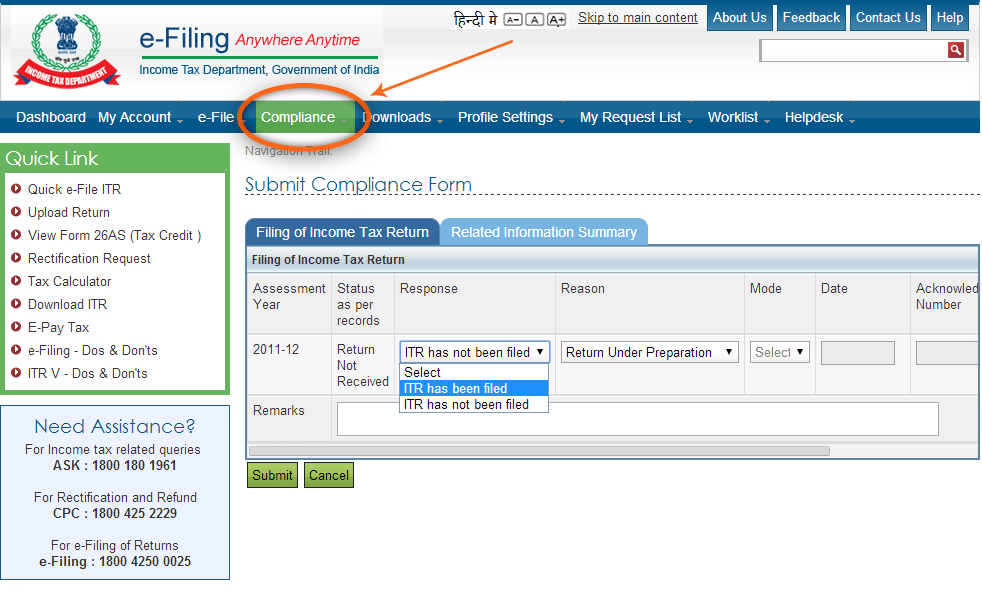

Upon successfully log in to the account click on the Compliance Tab. Taxpayer who has received a notice for non-filing of the Income tax return through an SMS should take the following actions. You may have to pay a penalty of up to Rs.

When the notice for reassessment is received it is always desirable to file the return signed by the assessee who is authorised to sign the return us 140 of the Income-tax. Under the compliance tab click on View and Submit my Compliance option. To take swift action against non-filers the income tax department has introduced a.

How To Reply Non Filing Of Income Tax Return Notice Detailed

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

Division Of Unemployment Insurance Faq Paying Federal Income Tax On Your Unemployment Insurance Benefits

Ownership Dispute Pay Attention To Schedule K 1 Pennsylvania Business Divorce

What Is This Thing Called Portal

No Extension For Filing Tax Returns Today Is Deadline

Upload And Understand Your Income Tax Notices

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

Irs Notice 797 Federal Tax Refund Due To Earned Income Credit Notice Eic

/2848-f0c6a242a34340aa97b1dcfbe3a539d6.jpg)

Form 2848 Power Of Attorney And Declaration Of Representative Definition

No Stimulus Check Irs Tells Non Filers To Check The Mail To Find Out How To Claim One

Not Filing Your Income Tax Returns On Time You Could Be Prosecuted Rahul Jain Nangia Andersen India Pvt Ltd

Income Tax Notice Response How To Respond To Income Tax Notice Online

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Irs Audit Letter 531 T Sample 1

Intimation U S 245 Of Income Tax Act Learn By Quicko

/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)

Form 843 Claim For Refund And Request For Abatement Definition

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog