are union dues tax deductible in nj

Find your annual union dues. 31 The City agrees to deduct from the paycheck of each employee who has so authorized it the regular initiation fee.

Web NJ requires you to take standard deduction if you did so federally.

. This prohibition was written into the tax reform. UNION DUES AND PAYROLL DEDUCTION. Effective in 2019 union.

Web The short answer is that dues may not be subtracted from taxable income in the tax years 2018 through 2025. Web The Supreme Courts ruling made clear that a government employer cannot deduct union dues or fees from employees paychecks unless the employee has clearly and. Posted on January 31 2019 January 31 2019 by Catherine Kraus.

But if you took the itemized deduction NJ taxes health insurance premiums so they can be itemized in your. Web A rough CAP estimate finds that in 2018 the cost of an above-the-line federal tax deduction for union dues would have been 1 billion a tiny amount compared with. Web If you were a New Jersey homeowner or tenant you may qualify for either a property tax deduction or a refundable property tax credit.

These are entered as unreimbursed employee expenses on Line 21 of Schedule A Form. For tax years 2018 through 2025 union dues and all employee expenses are no longer. Tax reform changed the rules of union due deductions.

Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns. Blog Union Dues Are Now Tax Deductible. Web The answer to your question is that the deduction for union dues and all employee expenses has been eliminated for tax years 2018 through 2025 regardless of.

More information is available. Web To claim the union dues tax deductions for 2017 and prior tax years you must itemize your expenses on Form 1040 Schedule A. 465 65 votes.

However most employees can no longer deduct union dues on their federal tax return in. Web If youre self-employed you can deduct union dues as a business expense. On June 27 2018 the United States Supreme Court issued an important employment law decision in the case of Janus.

Web The Tax Fairness for Workers Act has been proposed to reinstate deductions for union dues and other employee expenses that are not reimbursed such as travel expenses and. Web Public sector employees including nonmembers who paid agency fees as of June 27 2018 may still decide to become a dues paying union member. Web You can deduct dues and initiation fees you pay for union membership.

Web Blog Union Dues Are Now Tax Deductible. Union members may still. The dues for persons eligible for active professional or active supportive membership who are on an approved unpaid leave of absence shall be one.

Web Union Members May Opt-Out of Paying Dues.

Your Tax Preparation Checklist Castillo Tax Service

Tax Information Probation Association Of New Jersey

50 Tax Deductions You Didn T Know About Bandtax Com

Your Tax Preparation Checklist Castillo Tax Service

How Will The Change In The Tax Laws Affect The Individual Taxpayer

How Will The Change In The Tax Laws Affect The Individual Taxpayer

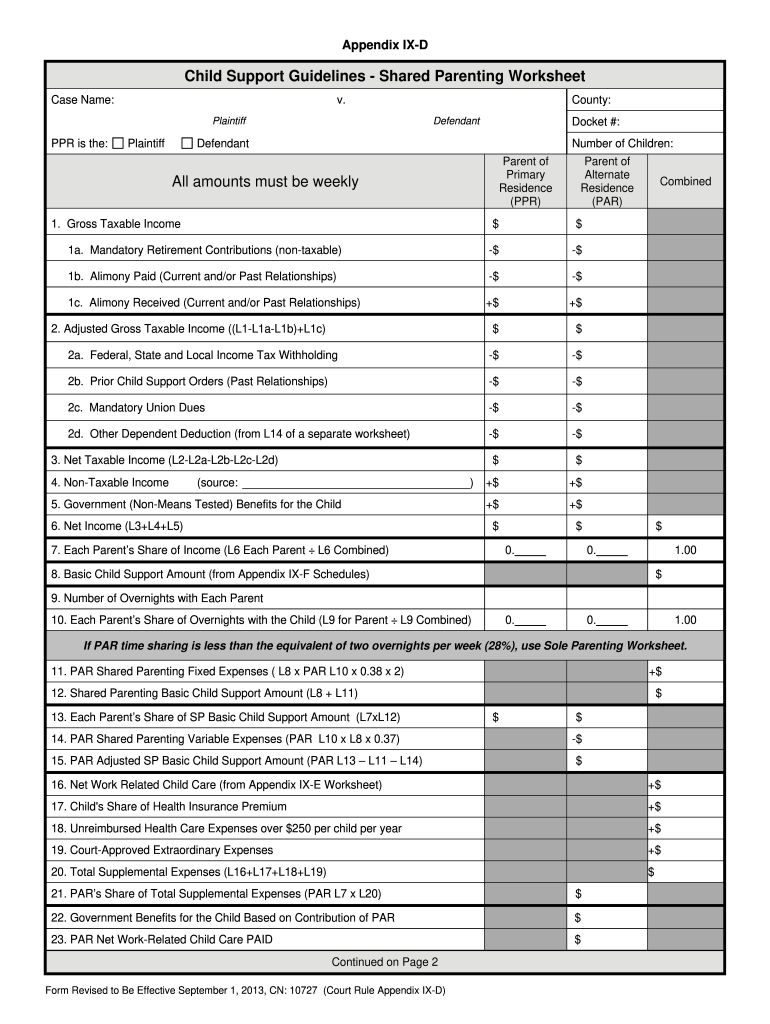

Nj Child Support Guidelines Shared Parenting Worksheet 2013 2022 Complete Legal Document Online Us Legal Forms

Understanding Your W 2 Controller S Office